NMC WORLD SERVICE

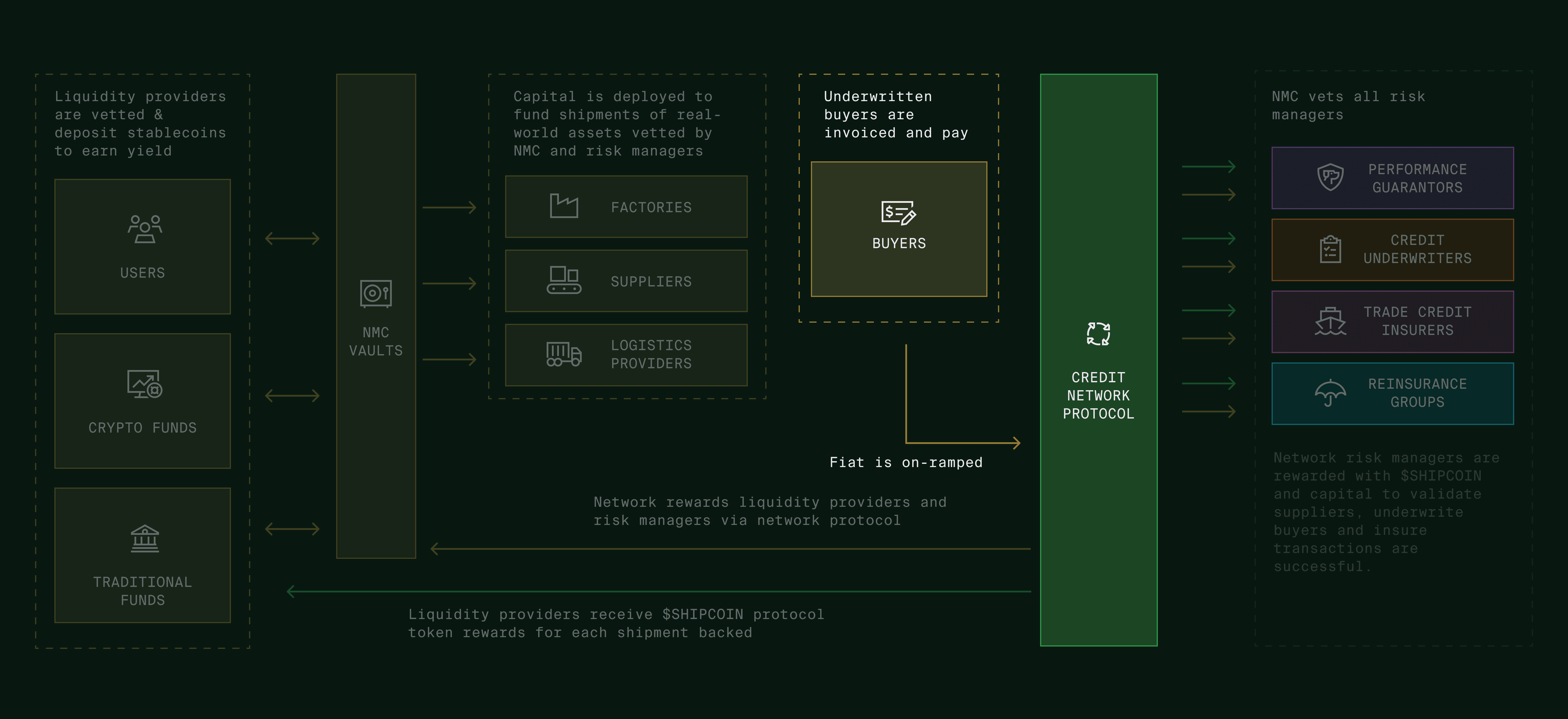

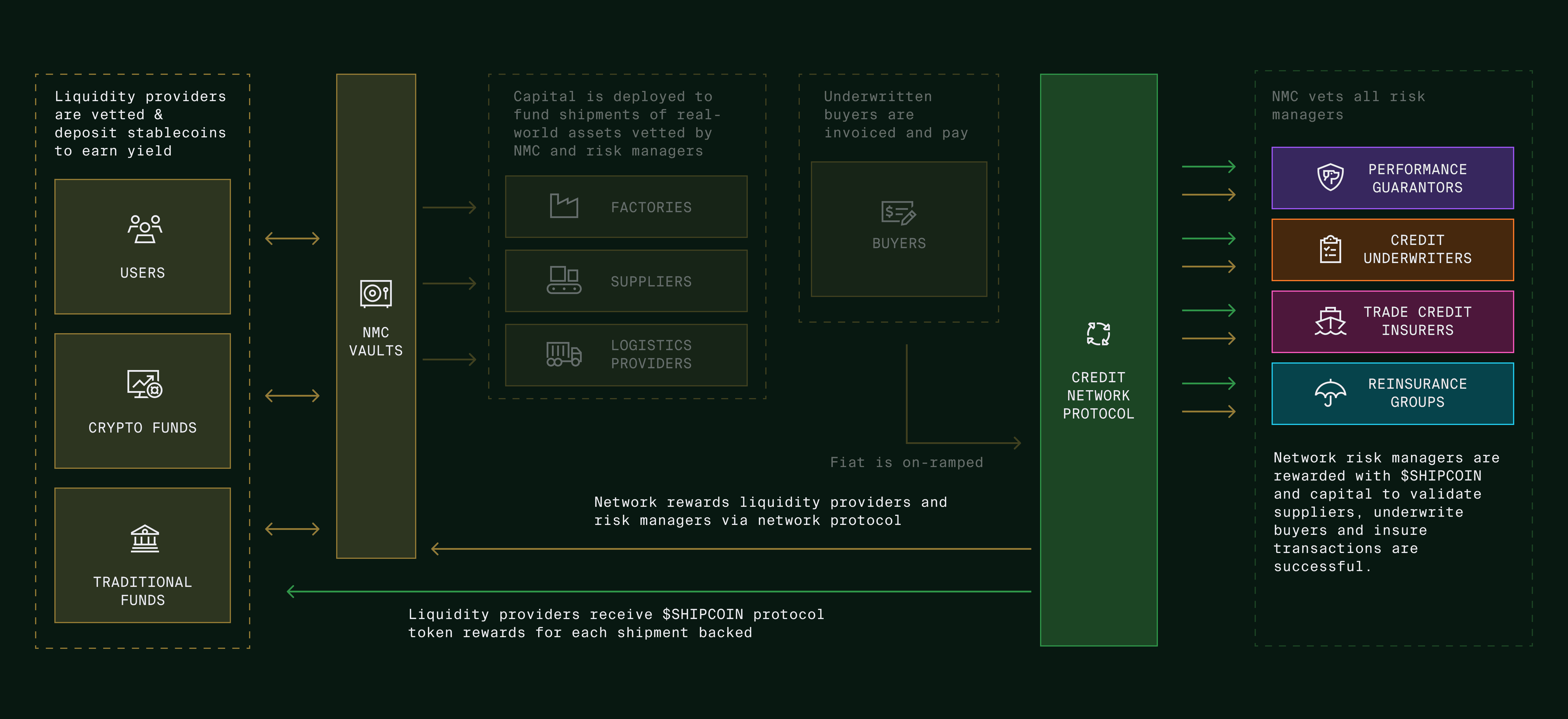

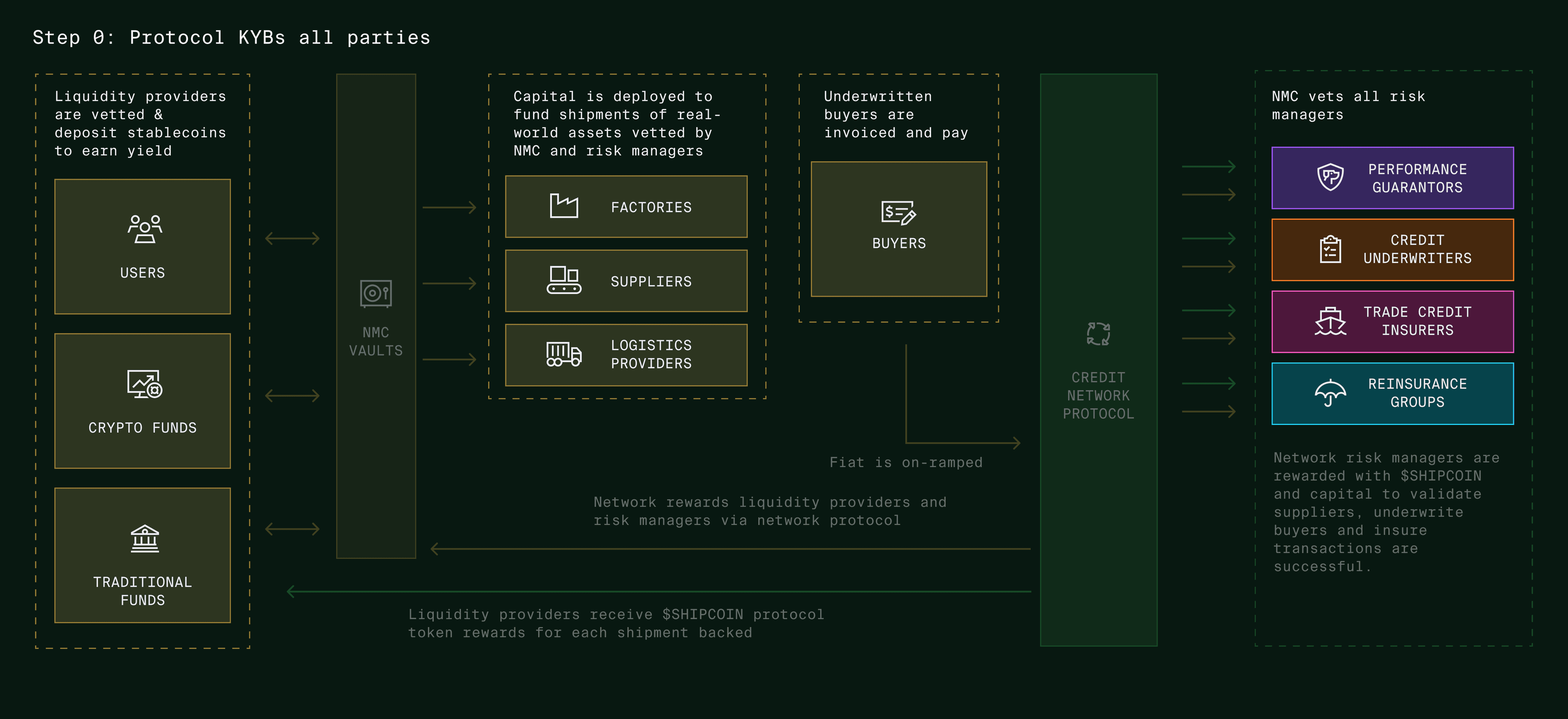

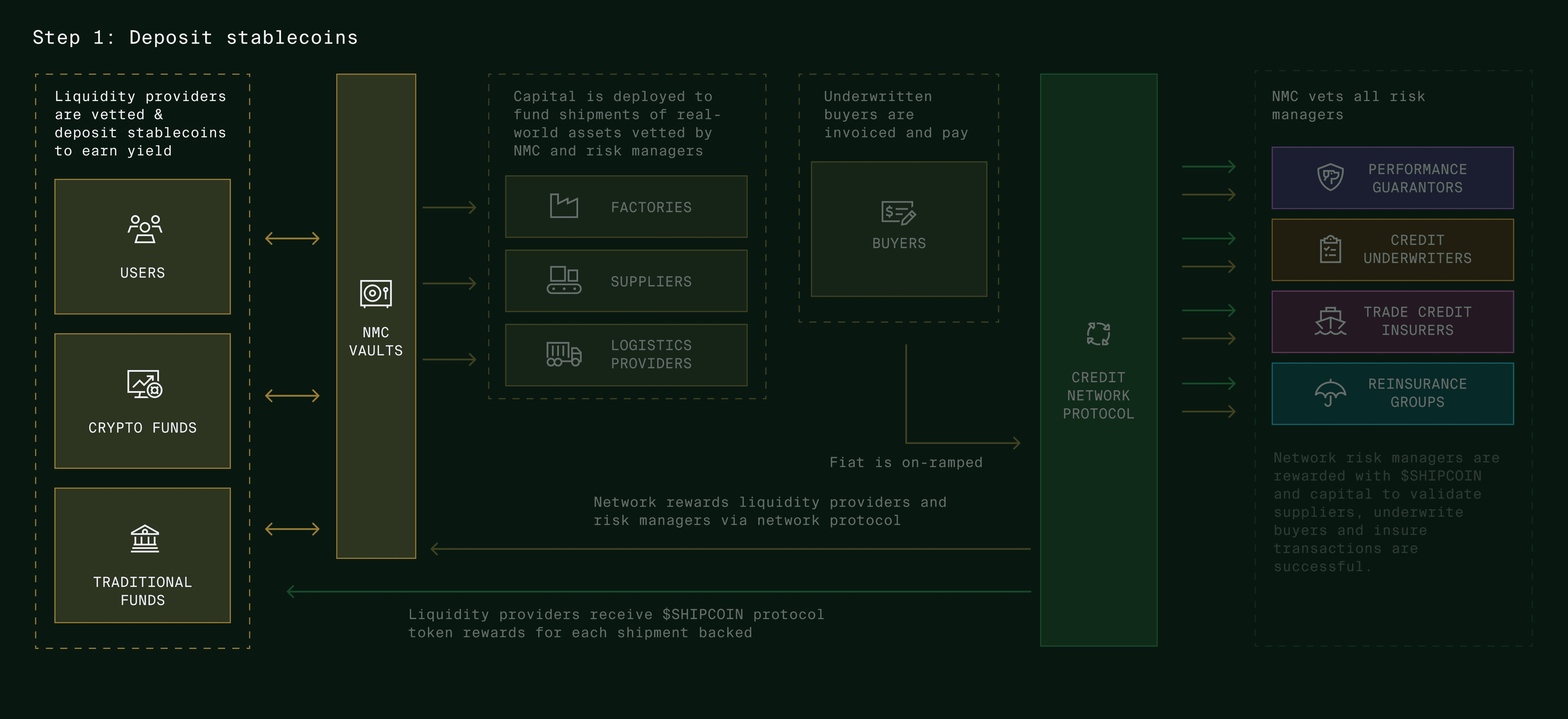

HOW IT WORKS

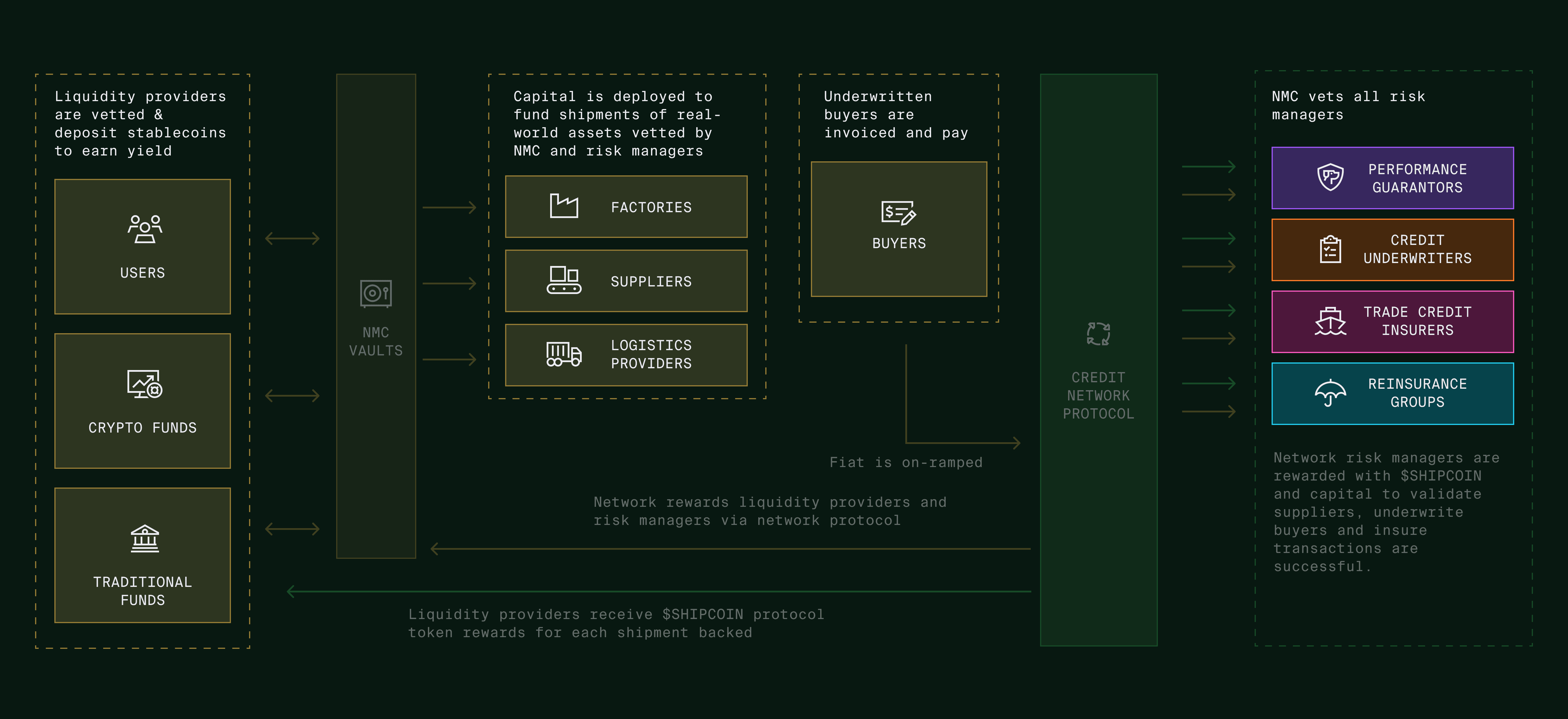

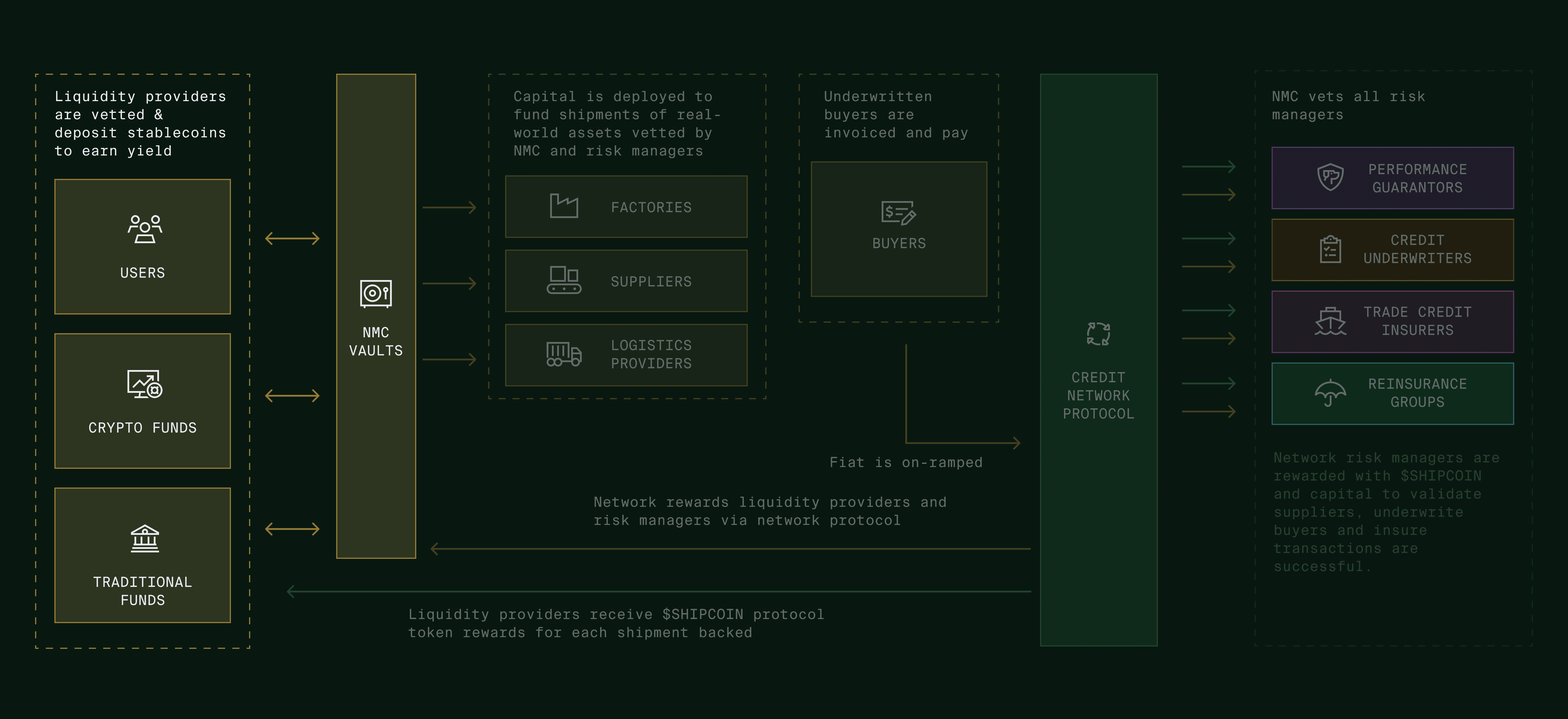

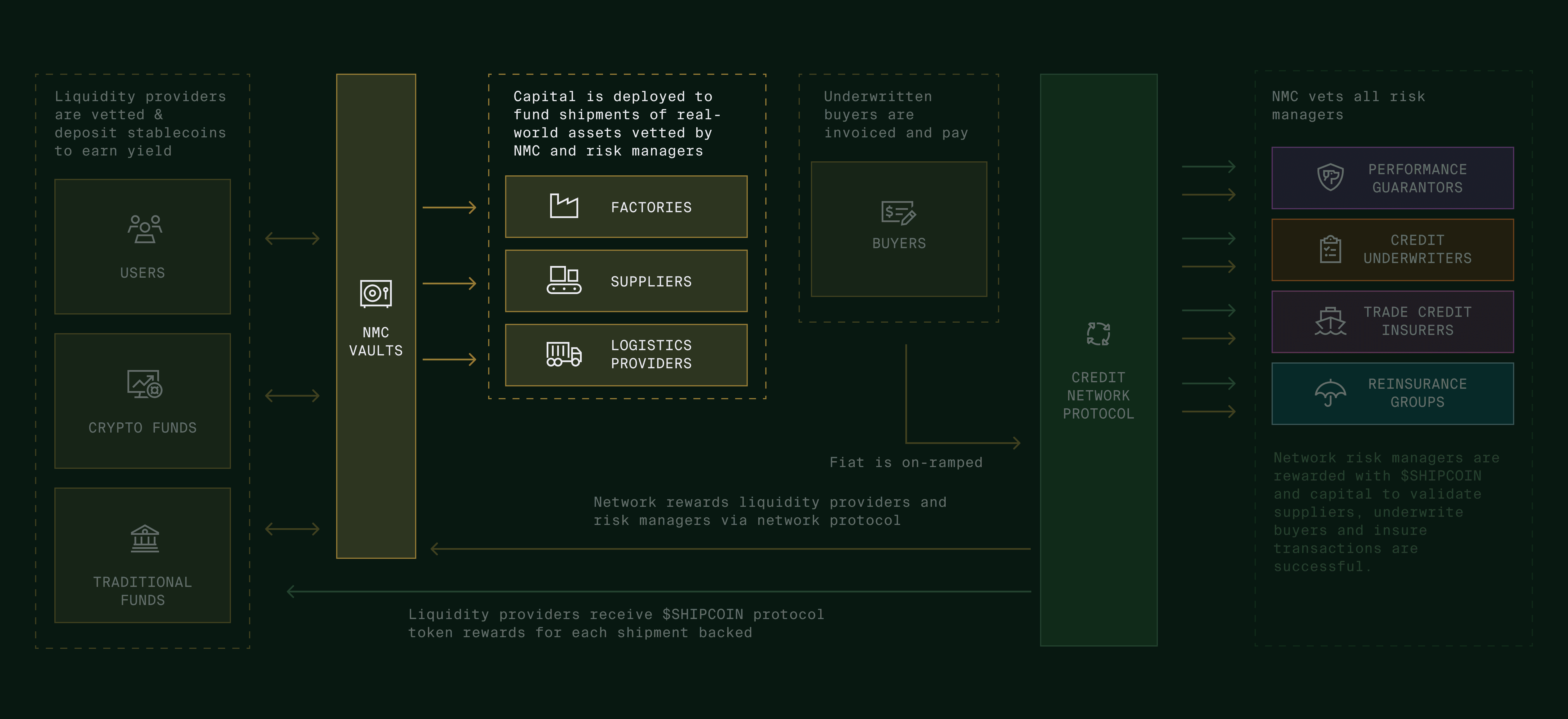

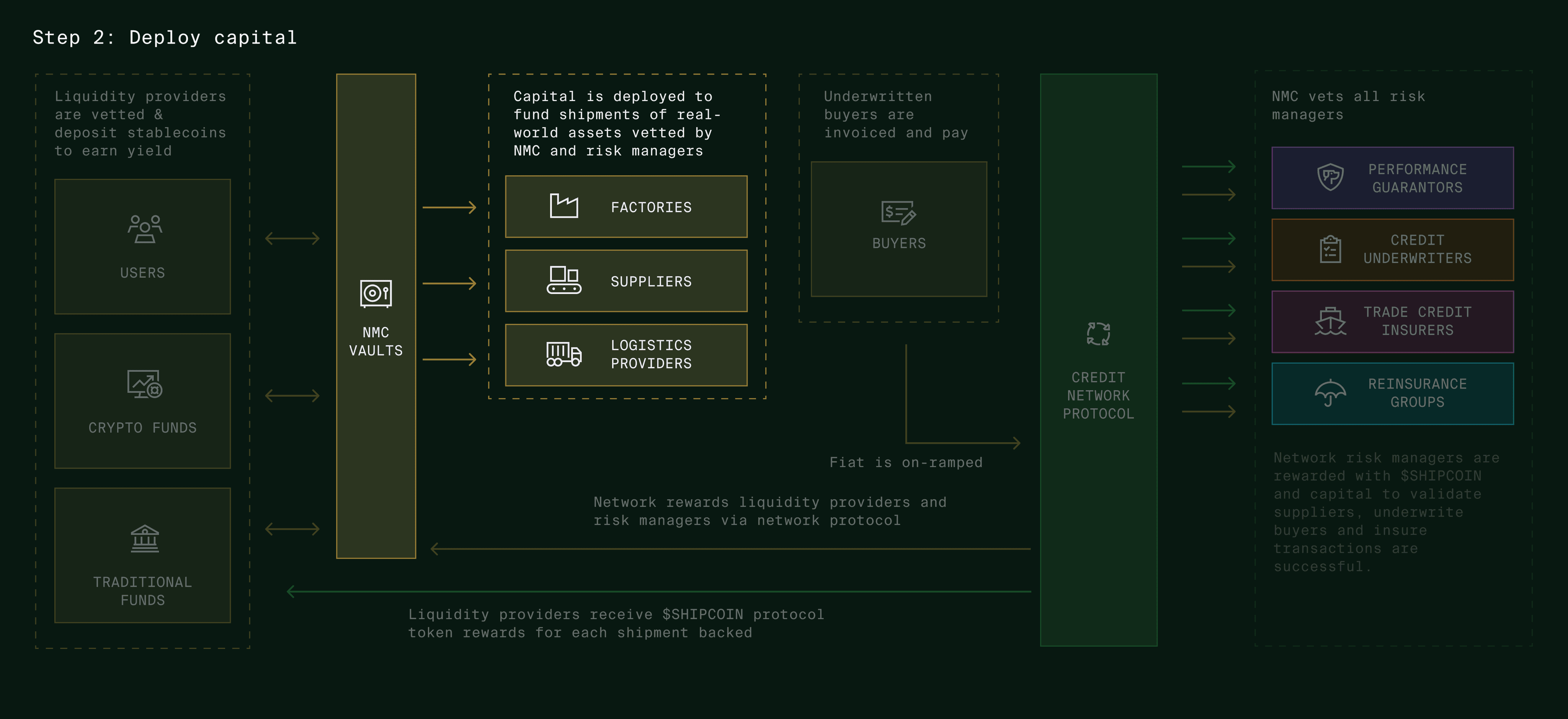

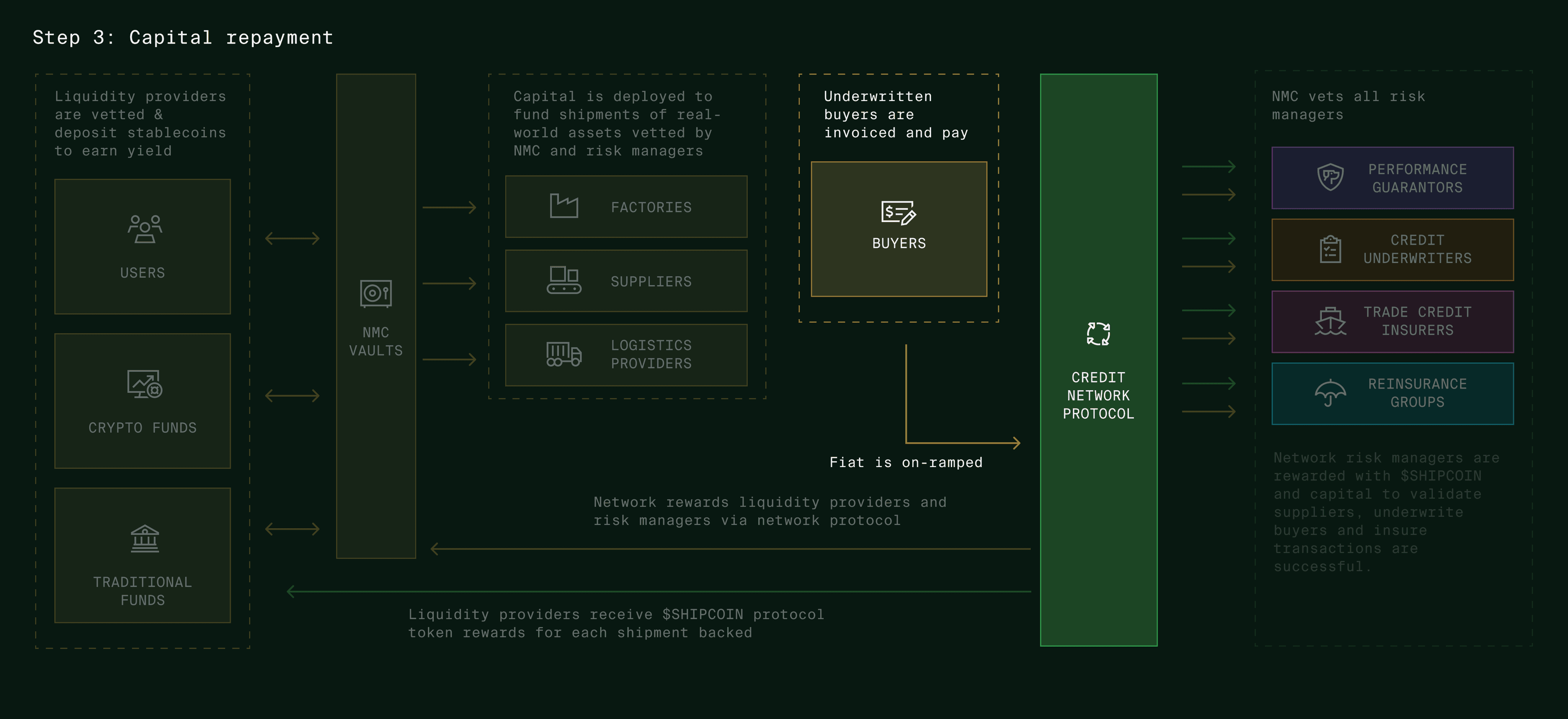

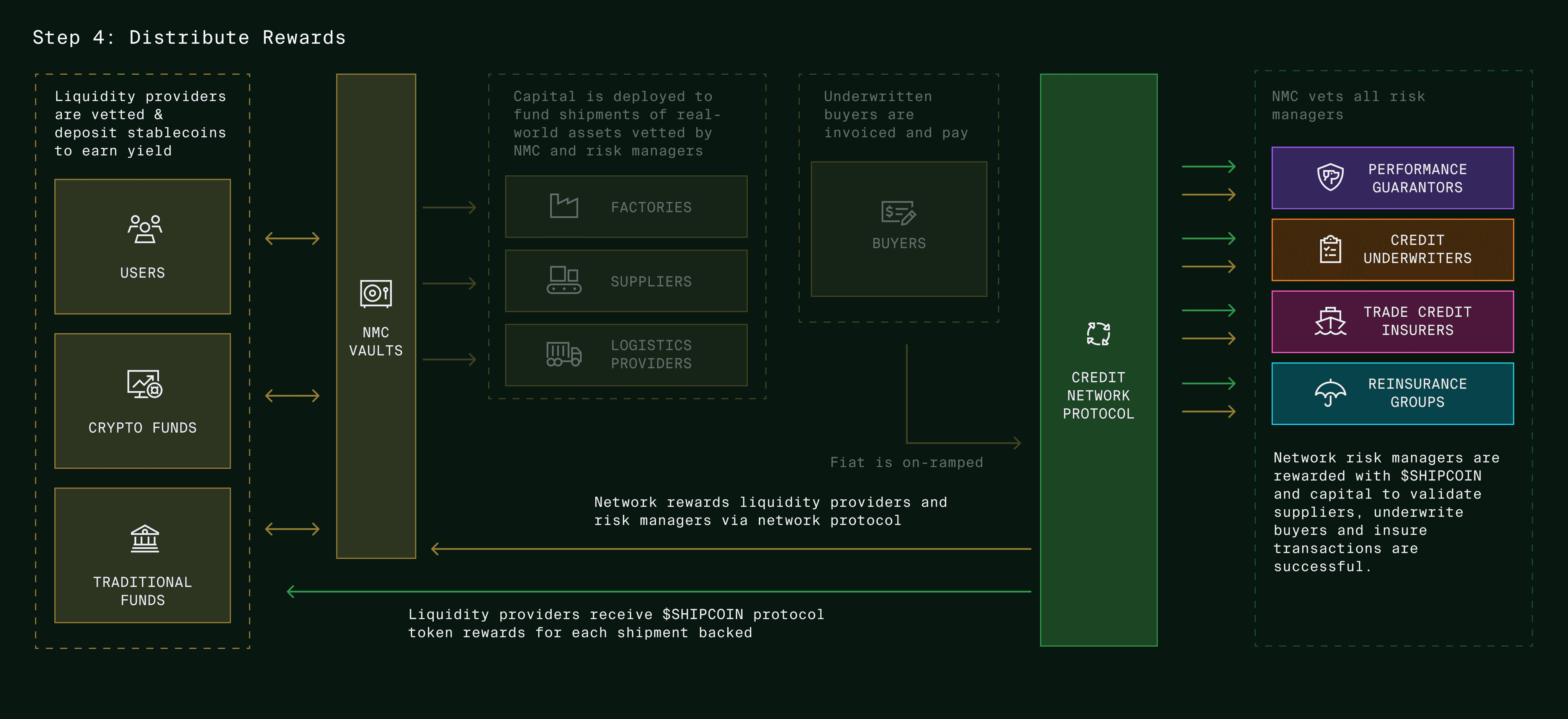

Flow of Funds

Risk management

The NMC World Service protocol utilizes a stack of controls to ensure trades are completed both accurately and efficiently. We are bringing the industry standards including insurance and inspections on-chain to mitigate risk to LPs.

By being the operational and commercial hub for buyer-seller coordination, we are the single source of truth for each transaction. This provides unmatched transparency reducing delays, surprises, and risk.

The oracle for global trade

Protocol level dispute management

A component of the protocol assigns a specific adjudication party. This party handles all disputes related to the trade.

Protocol risk controls

The NMC World Service protocol utilizes a stack of controls to ensure trades are completed. We are bringing the industry standards on-chain to mitigate risk to LPs.

Risk control parties are responsible and held financially liable to guarantee that their component of the trade is executed effectively.

To ensure accuracy, these entities stake capital and $SHIPCOIN in NMCbg, NMCsg, and NMCre vaults. Should they fail to accurate assess risk, both capital and $SHIPCOIN rewards are reduced or eliminated.

Risk control parties have the opportunity to earn a share of rewards, both capital and $SHIPCOIN, by accurate assessing risk and verifying performance of parties involved in the trade.

Risk stack